Spirits and wine sampling should deliver relationships. If it doesn’t, why not?

Over the course of writing this post, we are asking ourselves, and you, some tough questions.

As a spirits brand, are you building relationships that do not require distributor personnel?

Are you doing anything differently from the competition to enhance relationships with your key on-premise accounts? Doing things better or leading on price is a non-starter. What are you doing that is different?

When the marketing people say they know who buys your product, how do they really know? Sure they know the distributors who buy. They know the retailers and restaurant and bar accounts. Do they know who actually buys and loves your product?

We ask these questions to get your thinking juiced up.

We’ve asked people in your place these questions before. The responses?

We’ve found a tremendous amount of “this is the way we do it” or “we know our customers” and then one of the best ones, “our customers would never go for…”

We love hearing about all the sacred cows in the spirits, wine, and beer business.

Recently, one of our wine supplier contacts asked, “What’s the cost of using sampling-as-a-service software from Shared Spirits? What’s the ROI?

We find a better question is this. What do you consider as a measure of ROI?

For us, it’s ultimately the big picture, right? How much is the cost of production, marketing, sales, distribution, and G & A expenses compared to the revenue brought in from sales.

We see the spirits, wine, and beer industry’s Achilles‘ heel being this. The only measure of success is case counts.

The path to getting those cases sold is beat down. It’s a worn path that few stray from and as a result, the value proposition one spirits, wine, or beer brand has over another is indistinguishable.

Spirits and wine sampling should deliver relationships. If it doesn’t, why not?

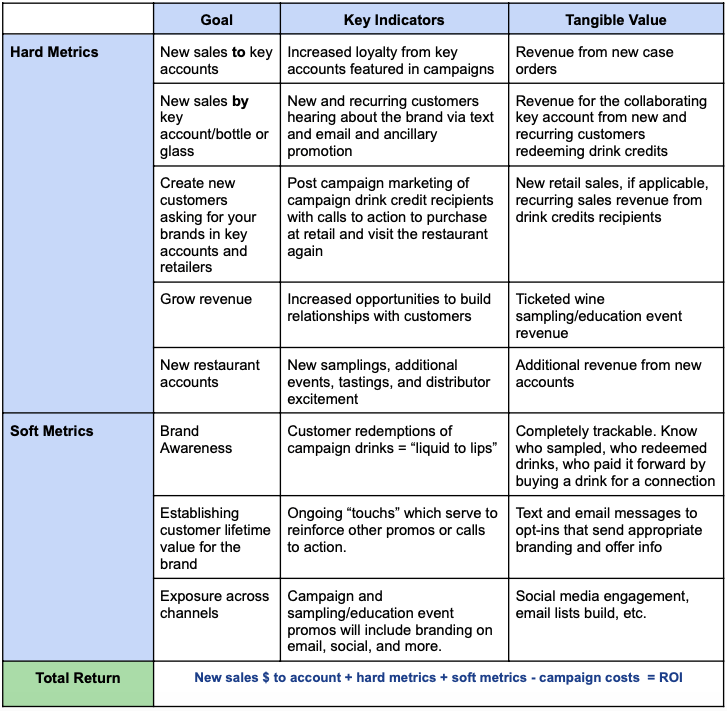

Few brands are building relationships with consumers who actually drink their product. No one actually knows what the customer life time value of a spirits, wine or beer consumer really is. Brands should be focused on this metric. Take a look at what our view of ROI is at Shared Spirits.

What is shared in the above table is a pathway for direct to consumer implementations and growth within your current on-premise network of distribution and relationships.

Do you understand what was just stated in the previous sentence?

Martin Green reported in Drinks International in Sept 2021:

“In the first quarter of 2021, AB InBev’s sales through owned e-commerce channels quadrupled in size. The world’s largest brewer reported that its courier platforms are now available in nine markets and 220 cities. Heineken, the world’s second largest brewer, reported that revenue doubled at its DTC platform in Europe, Beerwulf.

In the United States, producers sold $223 million worth of wine via their DTC channels in June, an increase of 18% on the previous year. That was despite a strong rebound in on-premise sales, highlighting a continued trend for home consumption in the world’s largest economy.

The spirits industry has lagged behind, but trade bodies are working hard to pave the way for a new era of DTC growth. The Distilled Spirits Council of the United States, American Craft Spirits Association and American Distilling Institute have joined forces to lobby the federal government to pass direct-to-consumer shipping laws.

Just nine states, plus the District of Columbia, permit DTC spirits sales, compared to 46 states that allow DTC wine sales. The trade groups are calling on the federal government to intervene. “In states where craft distillers have been permitted to ship their spirits direct-to-consumer, they report it has been a saving grace and a much needed source of revenue during the hardships of the pandemic,” said ADI president Erik Owens. The groups teamed up with IWSR to survey 2,000 consumers about the issue, and 80% said they supported direct-to-consumer sales.”

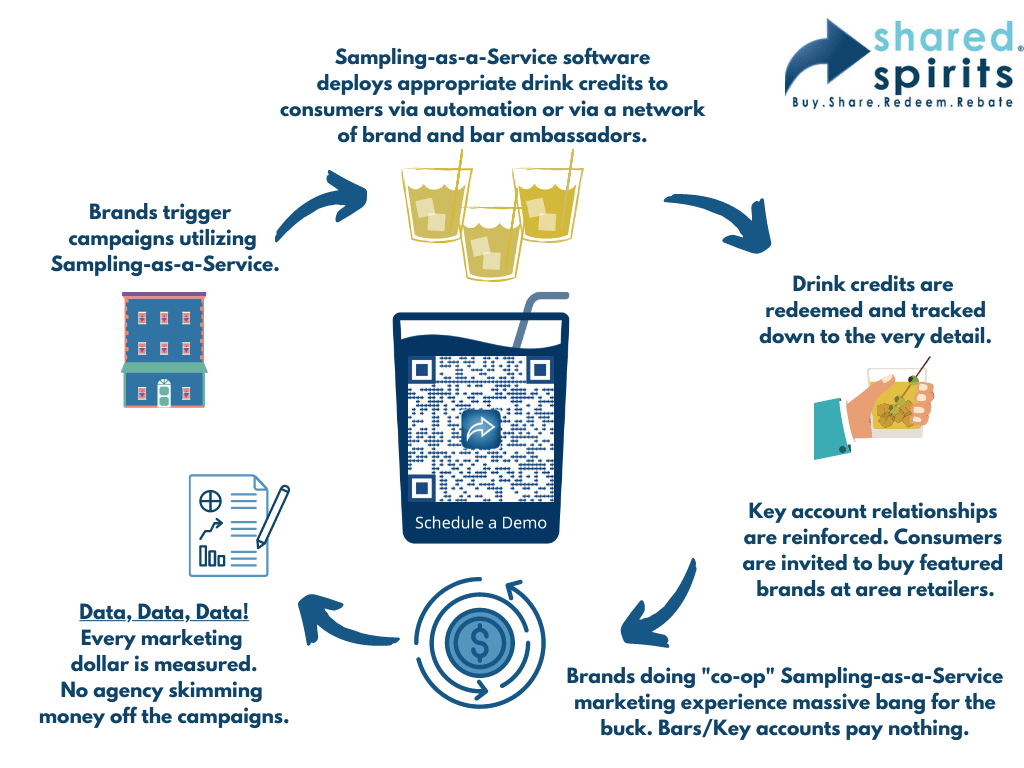

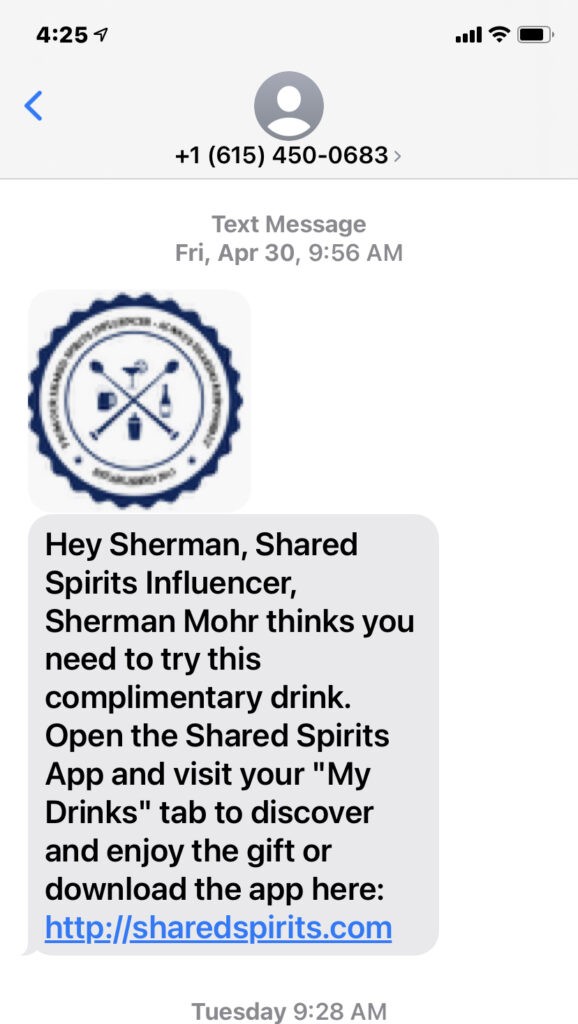

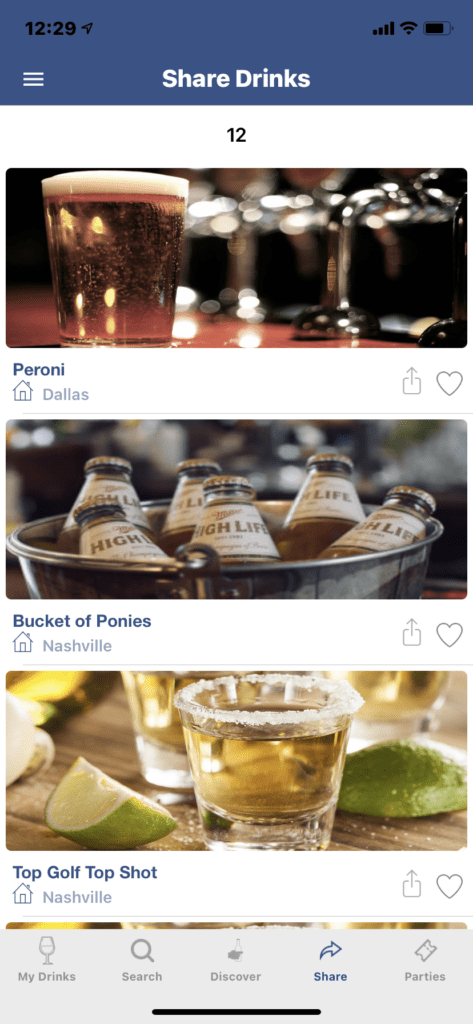

Our tools allow spirits, wine, and beer brands to compliantly convert marketing dollars into digital drink credits distributed via text messages out through our mobile technology. These drink credits flow into a network of your Ambassadors who in turn share them with connections, colleagues, friends, and family members. The recipients have to then redeem the digital drink credits in the participating on-premise accounts taking part in the campaigns.

As a result, there is an entirely new layer of relationship built around your brand.

First, the key on-premise account partner, restaurant or bar operator receives business as a result of the campaign.

Second, they had to purchase more product as a result of your campaign.

Third, the Ambassadors are measured for effectiveness in sharing, redemption rates, repeat buys, total ticket purchases, and metrics that start to deliver key correlations between the on-premise or event experience and retail gains.

Fourth, the foundations of customer life time value measurement begin to take form. After all, the elements I just described are actually “direct to consumer” activities.

For restaurants and bars, making use of the Shared Spirits Beverage Marketing Software is free of charge for the next few months. Some operators will qualify for special marketing arrangements as first movers in their cities.

To learn more about what Shared Spirits is all about, schedule a short 30 minute collaboration call with our CEO Sherman Mohr. We want your business! Schedule here.