Utilizing the Buyer Utility Map framework from Blue Ocean Strategy, found in the breakout business text Blue Ocean Shift, I’ll demonstrate why we are moving the adult beverage business to digital activation.

In this case, the buyers of sampling and tasting programs are spirits and wine brands and occasionally, the distributors that have agreed to rep their products. Be mindful that in today’s spirits and wine business in the US, the distributor has literally purchased the products from distilleries and vineyards or “suppliers”. There is a LOT of money at stake.

Diageo, the world’s largest spirits and wine conglomerate with 20% of the global market, spends about $2.5 billion annually up and down the supply chain on marketing related activities.

Sampling and tastings are the proven way spirits and wine brands get their “liquid to the lips” of prospective consumers. I spend considerable time sharing the brokenness of the current business model.

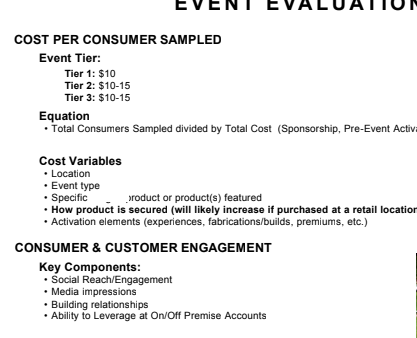

How broken is it? One big conglomerate or owner of multiple brands budgets $10 to $15 per person per activation to get their brands on the lips of attendees. They obtain no data on who the attendees are. They have no ability to continue to market to them directly. Their only measure of success in the measurement of case count sales.

Take a look at this screen grab with the supplier’s identity left out. This is not info generally shared.

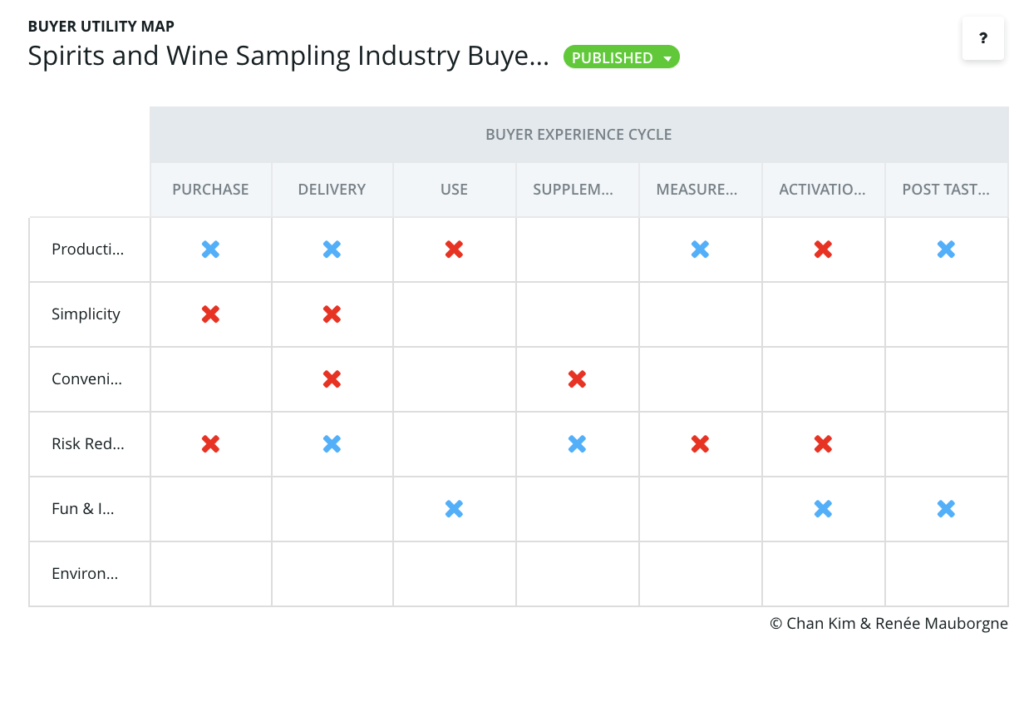

Today, I’ll introduce a graphic called a Buyer Utility Map. It showcases some issues and alternatives to the problems facing the industry.

This is a Buyer Utility Map for spirits and wine brands buying sampling and tasting services.

By locating a new offering on one of the spaces of the buyer utility map, managers can clearly see how, and whether, the new idea creates a different utility proposition from existing offerings but also removes the biggest blocks to utility that stand in the way of converting noncustomers into customers. In our experience, managers all too often focus on delivering more of the same stage of the buyer’s experience.

In our Buyer Utility Map, the red X’s denote the current issues facing our spirits and wine industry buyers. They are hurdles in the overall effectiveness of the Buyer Experience Cycle.

In the Purchase of sampling and tasting programs, simplicity and risk reduction are hurdles for brands. Pulling together a sampling or tasting program is complex. There are currently more moving parts than one may imagine. Review a typical state’s regulations around samplings and tastings and you will immediately identify with the complexity. South Dakota’s example here.

With respect to risk reduction, there are hurdles in abundance. When you rely on the work of dozens of others to pull off your expensive campaigns, the risk goes up.

In the Delivery of sampling and tasting programs, simplicity and convenience for the brand buyers and participants is non-existent. As mentioned before, the logistical complexities of sampling and tasting events are monumental.

Moving quickly through Use of sampling and tasting programs, ease of use in these programs is not a value prop. Brands are forced to manually tackle a lot of issues and hold their agencies accountable for activities that are not in their core business.

Questions to consider:

- How much product was given away during the sampling?

- How many sales were made the day of the sampling? Did you convert 30%, 40%?

- How did sales from weeks & months prior at this location compare to those that followed the event?

- How did this event measure up to past events?

- Did the event draw any media coverage?

- Was the event shared on social media?

- Did you provide a way for consumers to give you their email addresses or other contact info?

- Drawings, contests, newsletter signups?

- Do you have a method to attain customer feedback from the event?

There are lots of areas involved in holding an agency accountable for the success of outsourced samplings and tastings.

There are reasons that it is said that brands spend upwards of $30 dollars a head to get people tasting their products.

In Buyer Utility Map parlance, Supplement means, what else was required to successfully deploy the product, i.e. the tasting/sampling. In this case, generally, an agency is involved. If not an agency, all the trappings of one. Someone has to promote, be present, be educated on the brand, smile, and track the limited interactions that take place. With small brands, this is generally a closely held employee or a founder. With large brands, it’s an agency employee who knows and cares nothing about your brand. Hiring an agency is expensive and candidly, just the way it’s done. There are certainly brand ambassadors and the like and in most cases, even those are hired and trained by the agencies, thanks to antiquated laws governing the alcohol business.

When it comes to Measurement, current sampling and tasting programs are a joke. There are few technologies utilized to accurately measure who attends an event, what they partook of or enjoyed while present and what they did after the experience. Agencies understand that the only measurements involve “intent to buy surveys”, some measurement on depletion numbers in the weeks and months following a campaign and other age-old, less than current, methods of measuring sales.

In the Activation area, another keyword in the spirits and wine business, people are hired to do things ranging from calling on retailers and venues to building end cap displays to begging bars and restaurants to feature the brand on the back bar and menu. In other words, activation is the ability to translate sampling and tasting “buzz” into requests for the product at bars, restaurants, and retailers.

In the category I added, Post Tasting Marketing, brands don’t even currently have a shot. They don’t know who attended their tasting and sampling events. They don’t know who participated in the activation activities at the bar or venue. They just don’t know squat.

All of these hurdles are exactly what is happening in the sampling and tasting programs of spirits and wine brands.

So what’s a brand to do? It should begin moving the adult beverage business to digital activation.

In reviewing the Buyer Utility Map above, there are blue X’s that represent an alternative. In the areas where blue X’s appear, Shared Spirits and its technologies eliminate the hurdles in those categories. Candidly, the entire Buyer Utility Map could feature blue X’s thanks to the way Shared Spirits has approached the problems facing the industry.

Let me provide one example showcasing what would happen if the technology were employed. There would be massive uptake of the brand and more buzz generated than one could measure.

Let’s assume there are 100,000 Maker’s Mark Ambassadors. With the technologies and systems represented by the blue dots, we could identify where each Maker’s Mark Ambassador shops.

We can know how often they go to their favorite retailers and restaurants.

We can know their ancillary purchase habits.

We can compliantly share a drink/cocktail digital credit for their favorite drink or bottle at their favorite locations.

We can equip them with drink credits of their own and subsequently measure their true effectiveness as ambassadors.

We can know how effective every marketing dollar is related to depletion targets.

Most importantly, we can identify noncustomers of Maker’s Mark from other bourbon buyers and proactively migrate them into the customer fold.

Know how to measure event success

What’s the point of running a campaign or any event for that matter, if you have no way to measure its success? How will you know if your time, energy and money was invested into something useful or not?

Understanding what you want to achieve with any event is a great start, but without viewing your strategy and implementations outside of how one intends to capture nonconsumers is a risky way to spend money.

With the advent of ambassador and influencer marketing, Shared Spirits provides a Blue Ocean Strategy influenced brand activation pathway that may serve brands far better than previous models.

Shared Spirits owns digital activation. We have defined the category and deliver technology that serves the entire alcohol industry supply chain.

For a demo of our beverage program marketing software, click here. Our primary effort this year in the onboarding of restaurant and bar partners. We want your business!