Restaurants Lower Customer Acquisition Costs with Shared Spirits.

In a post by Toast POS titled RESTAURANT CUSTOMER ACQUISITION COST: HOW TO CALCULATE (AND LOWER) IT the company shared a breakdown on how to calculate customer acquisition cost and lower it.

Let’s look at the core assumptions. The following is directly from the Toast blog.

“Because there are so many variables in the customer acquisition cost, there’s no one equation that’s always used. The closest way to calculate restaurant customer acquisition cost is with this formula:

CAC = Marketing Expenses / Total New Customers

That may seem simple, but there’s a lot to unpack. For example, how do you get granular and differentiate between new and existing customers? Without a customer database, it’s not exactly easy to track who’s new to your restaurant and who’s not.

You also need to look at all of your marketing costs, including some you may not think of at first, like the amount you discount for a promotion.

Let’s say you run an online ordering campaign on Facebook, offering 10% off a guest’s first online order. You allot $1,000 for the Facebook ads – taken from the budget you created to market your restaurant on third party sites – but you also have to factor in the 10% discount on all the orders for new customers. This amounts to an internal loss on potential revenue in exchange for a new customer.

Example: Calculating CAC For Existing Restaurants

For existing restaurants, CAC is easiest to calculate when you are looking at specific, traceable campaigns, promotions, and ad sets.

The restaurant owner in the situation above spends $1,000 on Facebook ads targeting first-time online ordering customers with a 10% promotion. When looking at her restaurant sales data, this owner discovers her average ticket size for online ordering is $20. After the promotion is finished running, she learns the promotion was used 20 times, meaning she acquired 20 new customers.

Here are her variables:

- Facebook ads: $1,000

- Discounts on online ordering: 10% off of 20 orders of $20 (10% off of $400, or $40).

- Total new customers: 20

To calculate her CAC, we start by adding together the total marketing expenses of the Facebook ads and the cost of the discounts.

Marketing Expenses = $1,000 + $40 = $1,040

We then divide that number by the total new customers earned from this online ordering promotion.

CAC = Marketing Expenses / Total New Customers

CAC = $1,040 / 20 New Customers

CAC = $52 Per Customer

In this example, this restaurant owner spent an average of $52 to acquire each new customer from this campaign.”

Many of you likely are far more efficient marketers than the example above.

We wanted to share the way our system works for developing new customers.

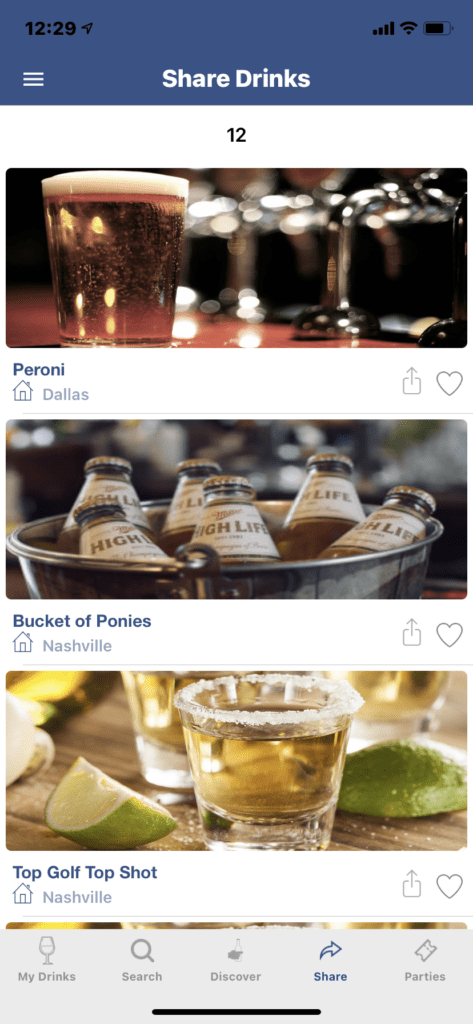

With Shared Spirits’ Sampling-as-a-Service software, we take popular items from your beverage menu and load them into the Shared Spirits mobile app.

The software immediately makes individual cocktails, wine, and beer buyable, shareable, and redeemable, all on mobile.

So let’s take a look at our math for a $1000 spend.

First thing to note, it’s not a discount model. We want you ringing up full retail!

In our model, the $1000 get’s compliantly converted to drink credits. Let’s assume it’s a $10 cocktail, all in with tax and tip.

This means we have 100 cocktails credited to your campaign in our software. We distribute these cocktails to a select group of patrons. Perhaps 20 who would receive a notification that they are now able to share 4 cocktails with friends, connections, or colleagues. We like the thought of them keeping one themselves.

The four drinks are shared with recipients who are now exposed to your establishment. That’s 100 exposures. Recipients have to redeem them at your establishment. The digital credits are tied specifically to your establishment.

Let’s assume a 40% redemption rate. By the way, we have visibility on all the sharing and redemption activity. You do as well.

If 40% of the 100 drinks come in for redemption, this is up to 40 new customers who are NOT seeking a discount.

40 people who buy appetizers, bring a friend, buy another round, and end up with a possible $68 tab.

This isn’t the entire story. Every time a drink is redeemed, we rebate 70% of the marketing spend, in this case $7.00 back to your establishment.

Your new customer acquisition costs is $3.00 per consumer with ZERO risk.

Why no risk? We charge the $1000 in this case but the money is escrowed for use for the campaign only.

If only 40 people redeem drinks, the remaining marketing dollars, in this case $600 stays in escrow for use in other campaigns.

So your total costs is $120 for 40 people in the seats.

$120 divided by 40 = $3.00 per customer.

Candidly, who spends more? Drinkers or non drinkers?

Successful bars and restaurants don’t rely on alcohol alone. They sell the atmosphere, the option to smoke a quality cigar, or special events such as karaoke night.

However, if you’re targeting customers with events or incentives to bring them in, you want them in when they’re ready to drink, Nielsen says. That means happy hour: The golden period from 5-8 p.m.

Nielsen’s number-crunching found that although happy hour is just 15 hours during the Monday to Friday period, it accounts for 60.5 percent of bars’ and restaurants’ business-week revenue. The food and drink bill, after any happy hour discounts, averages $68.99, $8 above the average for any other part of the day. On the weekend, happy hour income is only around 50 percent of the total.

We’d like to share more about the advantages of using your beverage program to acquire new customers and reinforce relationships with current patrons. Restaurants Lower Customer Acquisition Costs with Shared Spirits.

Click here to set up a collaboration call with our CEO, Sherman Mohr.